Bridging Borders with Africa: The 5 Pillars of Africa’s Cross-Border Payments Challenges

March 28, 2025

Bridging Borders with Africa: Rethinking Financial Inclusion in the Informal Economy with Lipaworld

April 17, 2025Cross-border payments are essential to Africa’s economic engine — driving trade, remittances, and investment. Yet beneath the surface lies a persistent and under-discussed issue: foreign exchange (FX) settlement risk. This hidden friction inflates transaction costs, delays fund flows, and traps liquidity across the continent.

This issue is captured in Pillar 1: Market Fragmentation & Structural Inefficiencies of our Five-Pillar Framework for Cross-Border Payments in Africa. It speaks to the disjointed infrastructure and reliance on third-party systems that continue to undermine efficient capital movement in and out of the region.

In this article, part of the Bridging Borders with Africa series, we unpack how FX settlement risk manifests in African markets, why it persists, and what’s being done to solve it. We also spotlight Sika, an infrastructure startup tackling this very challenge in the Global South, and speak with their CEO, Emmanuel Ashifri, about the bold vision behind their work. It is worth noting that the Global South spans emerging and frontier markets. For simplicity, we’ll refer to them as ‘emerging markets’ in this piece.

The Building Blocks of Transactions: Clearing and Settlement

Before diving into FX risk, it’s important to clarify the difference between clearing and settlement in the context of payments. In any payment process, two essential steps must occur — clearing and settlement.

Clearing refers to the process of validating, matching, and reconciling transaction details between counterparties before final settlement. It ensures that all aspects of the trade or payment, such as the amount, currency, sender/receiver accounts, and payment instructions, are accurate and compliant. In modern systems, clearing may also involve risk management, liquidity checks, fraud screening, and regulatory compliance reviews, including sanctions screening and Anti-Money Laundering (AML) checks, especially for retail and cross-border payments. (Source: Checkout.com)

Settlement is the final transfer of funds or securities between the parties involved in a transaction. It marks the completion of the transaction, where the agreed-upon value (e.g, cash or assets) is exchanged between financial institutions, typically via central banks, correspondent banks, or designated settlement systems (e.g., CLS, RTGS systems like Fedwire or TARGET2).

So in summary, clearing determines the commitments of the funds, whilst settlement involves the actual and final exchange of funds from the sender’s to recipient’s account

📌 A common misconception is that the Society for Worldwide Interbank Financial Telecommunication (SWIFT) is a settlement or clearing network. In reality, SWIFT is a messaging system which sends global payment orders to be processed by a clearing or settlement system. (Source: Modern Treasury, 2022)

Understanding FX Settlement Risk

FX settlement risk (also known as Herstatt Risk), occurs when one party in a foreign exchange trade delivers its currency, but the counterparty fails to deliver the currency it sold. This failure may be due to insolvency, delays, or operational error.

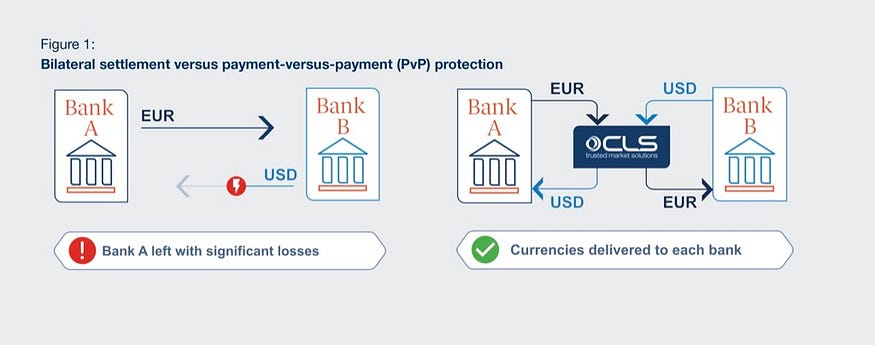

The term originated from the 1974 failure of Germany’s Herstatt Bank, which received Deutsche mark payments but failed to deliver U.S. dollars due to regulatory closure during operating hours. The incident prompted global regulators to develop infrastructure to reduce this type of risk. Established in 2002, CLS (Continuous Linked Settlement) enables the simultaneous settlement of both legs of a foreign exchange (FX) trade through a mechanism called Payment versus Payment (PvP). This process ensures that each party’s payment obligation is settled only if the counterparty’s corresponding payment is also settled, thereby eliminating settlement risk. (Source: CLS Group)

CLS currently supports 18 major currencies and is widely regarded as the gold standard for mitigating FX settlement risk. While the South African rand (ZAR) is included, it remains the only African currency currently supported by CLS. Though CLS has made substantial progress globally, the share of FX trades settled with PvP has declined — from over 50% in 2006 to under 40% in 2019. That means more than $8.9 trillion in trades are exposed to settlement risk each day, with potential losses of up to $2.8 trillion. (Source: BIS, 2020)

Why FX Settlement Risk Hits Harder in Africa

Africa faces a unique set of challenges that amplify FX settlement risk:

1. Reliance on Intermediary Currencies

Nearly 48% of African cross-border payments are routed through third-party currencies — typically the U.S. dollar. Instead of converting directly between African currencies, payments follow a costly and delayed path (e.g., KES → USD → NGN), increasing exposure to volatility and risk. (Source: SWIFT, 2013)

2. Limited Liquidity in Local Currencies

Many African currencies are tightly regulated or thinly traded, leading to delayed settlements and pricing distortions. Banks often hesitate to release funds until the counterparty has paid, locking up capital.

3. Lack of PvP Infrastructure

Unlike developed markets, most African FX transactions are not settled through PvP systems. This absence means payments are manually synchronized — introducing risk, delays, and operational complexity.

4. High Costs for Users

To manage these risks, banks pass on higher costs to users through wider spreads, pre-funding requirements, and fees. In some African corridors, remittance costs exceed 8–10%, far above the UN SDG target of 3%. (Source: World Bank Remittance Prices Worldwide, 2022)

5. Regulatory and Infrastructure Gaps

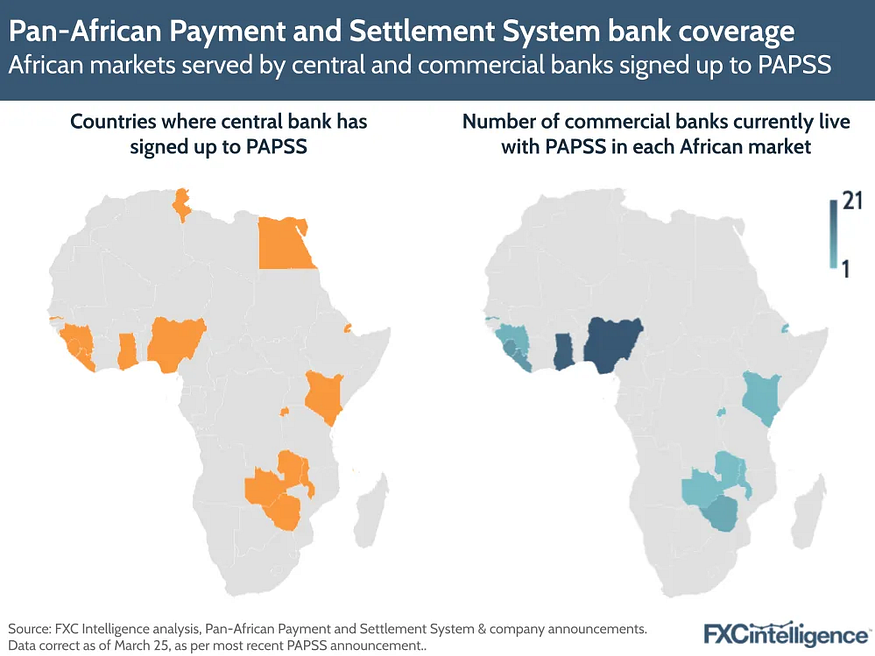

Africa lacks unified FX clearinghouses and regional RTGS (real-time gross settlement) systems. While initiatives like PAPSS (Pan-African Payment and Settlement System) are promising, adoption is still in early stages.

Spotlight on Innovation: How Sika Is Reimagining FX Settlement Infrastructure

To address these challenges, Sika is building a new financial layer: a central counterparty (CCP) clearing and settlement solution tailored to emerging markets. By acting as the trusted intermediary for trades, Sika guarantees settlement and eliminates counterparty risk.

Sika’s infrastructure includes:

- Central counterparty clearing: Guarantees execution by stepping in as the buyer to every seller, and vice versa

- Payment versus Payment (PvP): Ensures real-time, synchronized exchange of currency pairs

- Bi- and multilateral netting: Reduces total payment volumes, freeing up liquidity

- Support for emerging market currencies including BRL, MXN, MWK, NGN, ZAR, ETB, EGP, GHS, RWF, MZN, BWP, UGX, TZS, XOF, XAF, USD, GBP, EUR, USDT, USDC, INR, CNH

Interview with Emmanuel Ashifri, CEO of Sika

What inspired you to start Sika?

I saw a critical gap in the market: there was no financial infrastructure in place to guarantee settlement of trades in emerging markets. When I dug deeper, I was surprised to learn that no startup had ever built — or even attempted to innovate around — a clearing house. Most fintechs were focused on banking, wallets, or payment processing, but none were tackling the underlying infrastructure.

Yet FX settlement is the foundational layer that supports everything else. It’s complex and highly technical, but I saw it as the root cause of inefficiencies across payments in emerging markets. It cuts across all verticals — remittances, B2B payments, trade finance — and solving it unlocks massive value.

Because nothing like Sika existed, we had to build the entire system from scratch. That meant solving for liquidity, counterparty risk, and efficiency — particularly around time and cost. These three pillars are at the heart of what we do.

What’s the biggest misconception about the problem that you’re solving?

The biggest misconception is that this problem doesn’t exist. Many people overlook it or simply don’t understand how financial markets are structured. If you live in a country with seamless FX access, it’s easy to assume the system just works.

But for businesses operating across Africa and other emerging regions, the experience is completely different. Settlement delays, liquidity gaps, and failed trades are everyday problems. I believe these markets are operating at only 30% of their efficiency potential — there’s so much room for improvement.

How do you see Sika evolving?

Our vision is to become the financial infrastructure layer that powers settlement and clearing across all market verticals in emerging economies. Just as developed markets rely on established systems like CLS and DTCC, we want to bring that same structure and reliability to underserved markets.

What have you learned from building in this space that other fintech founders should know?

You need to be incredibly close to the problem — and deeply committed to solving it. This space is hard. It’s technical, messy, and often underappreciated. That means you need conviction, consistency, and the right motivation to keep going.

There’s a lot of noise and hype in fintech, and it’s easy to get distracted. But if you’re truly solving a real problem, stay focused and drown out the distractions.

Are there regions or markets that you look to for inspiration in solving this problem?

Definitely the Global North. Markets like the U.S. and Europe have built strong foundational infrastructure — CLS, DTCC, LCH, and others are the unseen engines that make financial systems run smoothly. In those regions, it’s unthinkable that you wouldn’t be able to send dollars from the U.S. to pounds in the U.K. due to liquidity issues. That’s the level of reliability we’re working toward in Africa and other emerging market economies.

What are your thoughts on incoming infrastructure like the Pan-African Payment and Settlement System (PAPSS) and its role in enabling cross-border payments?

We were actually one of the first market makers on the PAPSS platform. We provide liquidity and quote exchange rates for institutional participants on the platform — and today, we’re the largest market maker on PAPSS.

PAPSS plays a valuable role in building a marketplace where buyers and sellers of African currencies can come together to find fair value. What we’ve contributed is access to institutional liquidity and real-time pricing, which helps drive activity and confidence on the platform.

I strongly believe infrastructure like PAPSS is essential. You can’t leave it up to chance for counterparties to find each other and settle trades. We need structured systems that support collaboration and efficiency.

What ecosystem or industry-wide changes would help startups like Sika succeed?

Regulation is a big one. What we’re building is almost non-existent in most markets, so we’re often operating without clear regulatory frameworks or policies. Each country has its own rules, which makes it difficult to scale quickly across borders.

That’s why I’m excited by recent initiatives like the Ghana-Rwanda fintech licensing passport, which allows fintechs to operate in both countries under a single regulatory approval. If something like that could be expanded across more African countries — say five or ten at a time — it would massively reduce friction and accelerate growth for companies like ours.

Final Thoughts

FX settlement may seem like a backend issue — but it has real-world implications for businesses, SMEs, and households across Africa. As the continent pushes toward greater financial integration and trade, solving this bottleneck is no longer optional.

💡 Emerging markets process over $2 trillion in annual FX trade, yet over $50 billion in potential value is lost each year due to inefficiencies.

(Source: BIS, 2020)

Startups like Sika are not just building products — they’re designing the infrastructure that will power the next generation of African commerce.

You can support their mission by:

- Following their journey at sikafinancialgroup.com

- Exploring their solution if you’re a cross-border business

- Sharing this story with those working on financial infrastructure or African trade

If you know of other startups tackling cross-border payment challenges in Africa, I’d love to hear about them. And I’d also love to know — what do you see as the biggest barriers or opportunities in this space? Feel free to drop a comment or reach out directly.

About the Author

Victoria Olayide Adesanya is an emerging fund manager with over a decade of experience in finance. She has advised leading investment banks like Morgan Stanley and held roles at Credit Suisse and Barclays. As an active angel investor, venture partner and advisor, Victoria supports startups focused on financial inclusion and cross-border payment challenges in Africa. Based in New York City, she holds a First Class degree from the University of Nottingham and is a CFA charterholder.

Get the Latest from Bridging Borders with Africa

Be the first to read our in-depth analysis, founder interviews and cross-border fintech insights.