Bridging Borders with Africa: Reimagining FX Settlement Risk with Sika

April 10, 2025Africa’s financial landscape is incredibly complex and diverse, shaped by its 42+ currencies, varied financial systems, and regional disparities. While this diversity reflects the continent’s rich cultural and economic differences, it also presents significant challenges in the realm of cross-border payments. For example, currency conversion rates, lack of interoperability between payment systems, and varying financial regulations between countries create inefficiencies that slow down transactions and drive up costs. These challenges not only affect businesses operating across borders but also hinder everyday consumers, especially those who depend on remittances or cross-border trade.

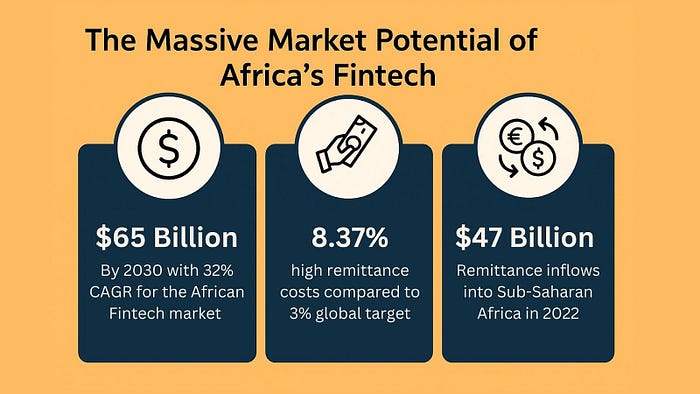

Despite the surge in fintech innovation across the continent, where startups are creating new solutions and disrupting traditional financial models, cross-border transactions remain prohibitively expensive, fragmented, and inaccessible for many. In fact, the average cost of sending remittances to sub-Saharan Africa is still nearly 8%, according to the World Bank, far higher than the global target of 3% set by the UN’s Sustainable Development Goals. These high costs disproportionately impact small businesses, entrepreneurs, and individuals who rely on the flow of capital to participate in the global economy.

Drawing on extensive research and firsthand experience as both an investor and advisor in the fintech space, this article aims to break down the key barriers that prevent Africa from fully realizing its economic potential. By presenting a five-pillar framework, we’ll examine the systemic challenges that persist in African cross-border payments and discuss why addressing these barriers is not just an opportunity but a necessity for unlocking Africa’s full potential in the global economy.

Why This Matters to Me

I’ve spent most of my career in finance and startup advisory, and if there’s one thing I’ve learned, it’s the importance of spending time on meaningful, high-impact work. Over the last two years, I’ve been deeply involved in fintech as an investor and advisor, gaining the practical skills to support startups tackling these challenges.

My thesis is simple: Africa must be seamlessly integrated into the global economy. Yes, there are deep-rooted structural barriers that have historically sidelined Africa in global markets, but innovation doesn’t wait for permission. It creates new possibilities. This is why my focus is on backing startups that facilitate the efficient movement of capital in and out of Africa, particularly through payments infrastructure.

Imagine:

- An African small business gaining customers beyond its local market.

- A multinational company setting up operations in Africa because capital flows are seamless.

- => This leads to more jobs, financial inclusion, and economic participation, ultimately driving higher GDP growth.

Yes, the long-term vision is for Africa to become a key player in the global economy, but the short-term wins — reducing unemployment, expanding financial access, and enabling new business opportunities — are just as critical.

The 5 Pillars of Africa’s Cross-Border Payments Challenges

Many Africans already recognize the continent’s potential. Africa has the youngest population globally and is set to represent a quarter of the world’s population by 2050. However, to truly capitalize on this opportunity, Africa must be fully integrated into the global financial system — not treated as an afterthought.

The rise of unicorns like Flutterwave are worth celebrating, but Africa’s cross-border challenges are far from solved — especially within payments. Before discussing solutions, we must understand the problem in its entirety.

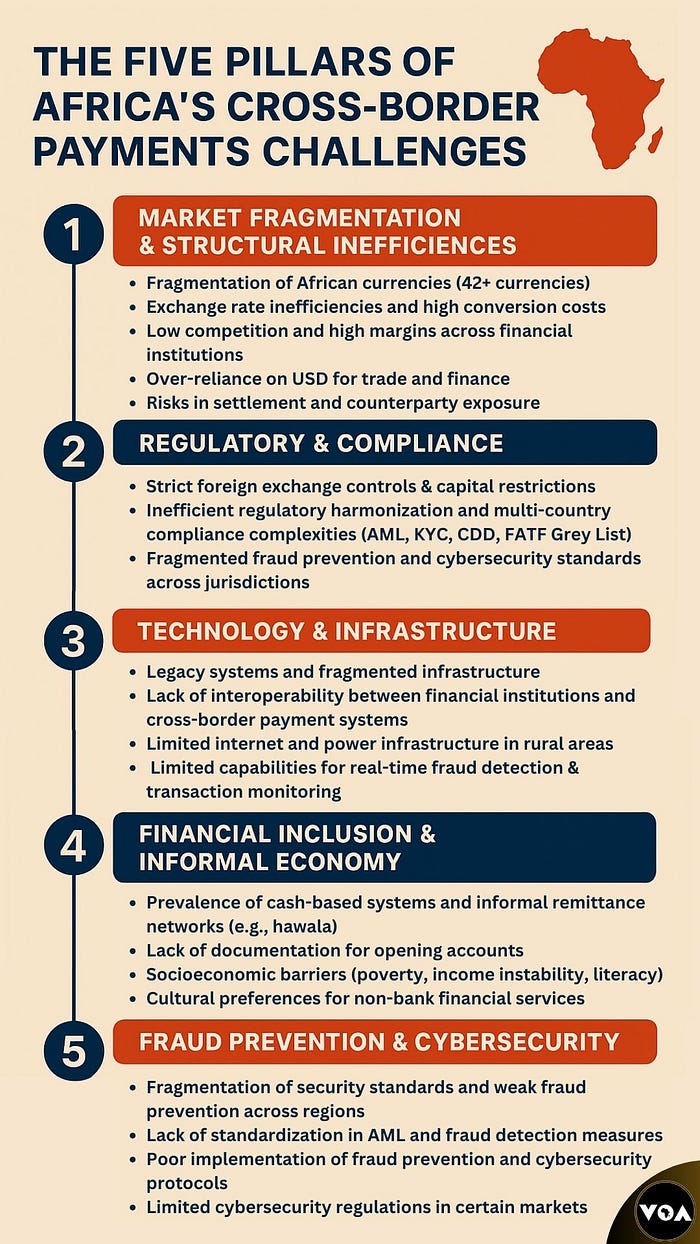

Here’s a structured breakdown of the key barriers, with additional explanations below:

The 5 Pillars of Africa’s Cross-Border Payments Challenges EXPLAINED

1️⃣ Market Fragmentation & Structural Inefficiencies

Africa’s diverse financial landscape — comprising 42+ currencies — leads to inefficiencies that are costly for businesses and consumers. Currency conversion, lack of interoperability between payment systems, and inconsistent regulatory standards make it difficult to facilitate smooth, cross-border transactions. Companies often rely on expensive intermediaries, adding layers of complexity and cost.

2️⃣ Regulatory & Compliance Challenges

Each African country has its own regulatory framework, often leading to confusion and costly compliance requirements. Moreover regulations are constantly evolving, creating an unpredictable environment for businesses. Compliance issues like Know Your Customer (KYC) and Anti-Money Laundering (AML) laws also complicate cross-border payments, making it harder for fintech startups to scale rapidly across the continent.

3️⃣ Technology & Infrastructure Gaps

While mobile money usage has been a game-changer for many Africans, a lack of unified infrastructure still presents challenges. From unreliable internet connectivity in rural areas to limited access to mobile payment platforms, gaps in technology infrastructure restrict the growth of cross-border payment solutions. This is particularly evident in markets where mobile payment systems like M-Pesa have not yet reached full penetration.

4️⃣ Financial Inclusion & Informal Economy Dynamics

Over 60% of Africa’s population is unbanked or underbanked. Many Africans still rely on cash-based transactions. Informal economies further complicate cross-border payments, as businesses and individuals often avoid traditional financial services due to lack of trust, high fees, or inaccessibility.

5️⃣ Fraud Prevention & Cybersecurity Challenges

As the African fintech sector grows, so does the risk of cybercrime and fraud. Cross-border payments are particularly vulnerable, with multiple jurisdictions and financial systems creating opportunities for fraudsters. For instance a recent study by PwC found that 74% of organizations in East Africa prioritize cyber risks. With cross-border transactions becoming more frequent, it’s crucial to implement stronger cybersecurity measures to protect businesses and consumers alike.

These pillars represent the core challenges that, when solved, will unlock Africa’s full potential in the global economy.

What’s Next?

This is just the beginning. In this biweekly article series, we will:

✅ Deep dive into each pillar, unpacking the real challenges

✅ Spotlight innovative startups solving these problems

For those unfamiliar with the African fintech landscape, I hope this series provides a clearer understanding of both the challenges and the incredible work being done. And for those deeply embedded in the ecosystem, I hope it reinforces the urgent need for more investment in this space.

Your Thoughts?

I’d love to hear your thoughts — what do you see as the most pressing challenge or opportunity in African cross-border payments? Drop a comment or reach out with your insights on startups, policy shifts, or technologies making an impact!

About the Author

Victoria Olayide Adesanya is an emerging fund manager with over a decade of experience in finance. She has advised leading investment banks like Morgan Stanley and held roles at Credit Suisse and Barclays. As an active angel investor, venture partner and advisor, Victoria supports startups focused on financial inclusion and cross-border payment challenges in Africa. Based in New York City, she holds a First Class degree from the University of Nottingham and is a CFA charterholder.

Get the Latest from Bridging Borders with Africa

Be the first to read our in-depth analysis, founder interviews and cross-border fintech insights.