Bridging Borders with Africa: Rethinking Financial Inclusion in the Informal Economy with Lipaworld

April 17, 2025

Bridging Borders with Africa: Addressing SMEs Cross-Border Payment Challenges with meCash

May 8, 2025In 2022, the US dollar was involved in 88% of all global foreign exchange transactions, up from 85% in 2010 — even as emerging markets expanded their share of the global economy (BIS Triennial Survey). The dollar’s dominance is clear. Yet for many African economies, accessing USD remains a persistent and costly challenge.

In this fourth article of the Bridging Borders with Africa series, we explore why Africa remains so reliant on the US dollar — and why obtaining it is often far from straightforward. This connects directly to Pillar 1 of our Five-Pillar Framework: Market Fragmentation and Structural Inefficiencies.

We also shine a light on Juicyway, a fintech platform leveraging crypto infrastructure and real-time currency matching to improve access to hard currencies across the Global South, starting with Nigeria — and hear from its CEO and Co-Founder, Ife Johnson, about their unique approach and bold vision for the future.

The Historical Roots of Dollar Dominance

The US dollar (USD) is widely regarded as a hard currency — a currency issued by a politically and economically stable country, globally traded, and broadly trusted. It has held the position of the world’s primary reserve currency for over 80 years, a role solidified in the aftermath of World War II.

Before the dollar’s rise, the British pound sterling served as the dominant reserve currency. But in 1944, delegates from 44 allied nations convened in Bretton Woods to design a new international monetary system. As explained by federalreservehistory.org, the goal was to avoid the volatility of past gold standards and the economic instability of the Great Depression. The agreement established both the International Monetary Fund (IMF) and the World Bank (then the International Bank for Reconstruction and Development). Crucially, because the United States held the largest gold reserves at the time, the US dollar was pegged to gold at $35 per ounce, and other currencies were pegged to the dollar within a 1% band. This meant countries settled international payments in dollars, which were themselves convertible to gold — making the USD the de facto global reserve. This arrangement gave the US a major advantage in global trade and capital markets.

In 1971, faced with mounting deficits and dwindling gold reserves, President Richard Nixon ended the dollar’s convertibility to gold, effectively moving the world to a fiat currency system — where the value of money is backed not by physical assets but by government credibility. Despite this shift, the dollar’s dominance has endured. According to the US Department of the Treasury, the USD’s ongoing importance is underpinned by the scale, strength, and liquidity of the US economy — especially its deep financial markets and highly liquid Treasury bond market, which make US assets easy to buy and sell.

And while BRIC currencies like the Chinese renminbi continue to make strides, the US dollar remains the most used currency in the world today — especially for global trade and for converting between less liquid currencies.

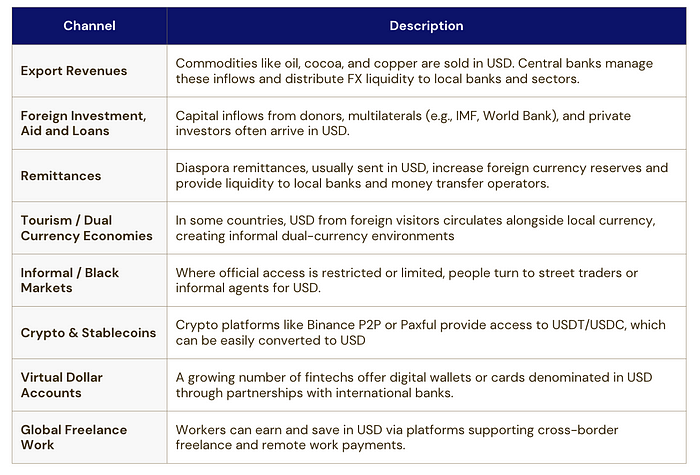

How Emerging Markets Access USD Today

Access to USD is vital for participation in the global economy. Developed markets typically enjoy deep FX markets and unrestricted currency convertibility. But in emerging markets — including much of Africa — access is more fragmented, restricted, and costly.

While these access points exist, they are often unreliable, inefficient, or simply out of reach for much of the population. Which brings us to the deeper issue — why access remains so difficult despite these channels.

Key Barriers to USD Access in Emerging Markets

Although there are multiple avenues to obtain US dollars, these flows are often insufficient, volatile, or costly. Structural weaknesses — ranging from commodity dependency and shallow financial markets to regulatory bottlenecks and geopolitical risks — create persistent barriers to affordable and reliable USD access across the Global South:

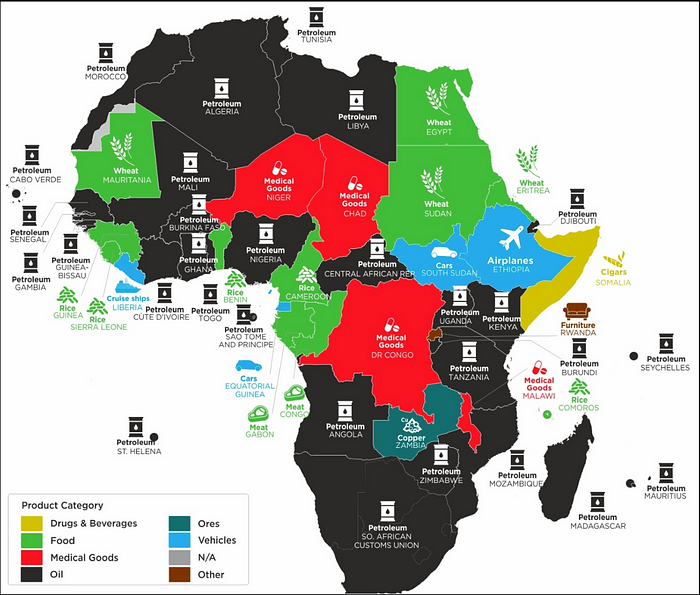

- Commodity Exports: Most USD inflows in emerging markets comes from commodity exports. But these are vulnerable to price shocks and global demand cycles. When prices fall, so do dollar reserves. Moreover, these countries often import finished goods, which must be paid for in USD, creating a persistent demand-supply imbalance.

- Tourism, Remittances, and Aid Fluctuate: Political instability, pandemics, or conflict can significantly disrupt these USD inflow channels, creating volatility and FX scarcity.

- High USD-Denominated Debt: Many emerging markets borrow in dollars due to underdeveloped local capital markets. When local currencies depreciate, repaying these debts becomes more expensive, driving up USD demand and putting pressure on reserves.

- Illiquid or Controlled FX Markets: In many cases, central banks limit access to USD to preserve reserves, resulting in unofficial markets with worse exchange rates and limited transparency.

- US Monetary Policy Spillovers: When the US raises interest rates, capital flows out of emerging markets, strengthening the dollar and weakening local currencies. This cycle makes accessing USD even more difficult and expensive.

- Geopolitical & Regulatory Friction: Countries facing sanctions are blocked from accessing USD payment systems like SWIFT. Even countries not under sanctions can face “de-risking” by global banks that cut off correspondent banking relationships in higher-risk regions.

Why These Challenges Are Even More Acute in Africa

While Africa shares many of the same structural constraints as other emerging markets, several factors exacerbate the continent’s dollar access challenges:

1. Heavy Import Dependency

Most African economies import significantly more than they export, particularly high-value essentials such as machinery, pharmaceuticals, refined fuels, and technology — all typically priced in USD. This creates chronic trade deficits and sustained pressure on dollar reserves.

2. Rising Debt Burdens

Many African governments and corporates have borrowed in USD, largely due to shallow domestic capital markets and more favorable interest rates abroad. But when local currencies depreciate, debt servicing becomes more expensive, draining reserves and intensifying demand for dollars.

According to UNCTAD’s Africa 2024 report, nearly half of African countries had debt-to-GDP ratios above 60% in 2023, with some spending more on debt interest than on healthcare or education.

3. Regulatory Frictions and FX Controls

Limited FX reserves and, in some cases, weak central bank credibility have prompted strict capital controls, multiple exchange rates, and heavy intervention in FX markets. These distort price signals, crowd out legitimate FX access, and push many to the informal market.

Some African countries also face sanctions, are placed on financial gray lists, or suffer from bureaucratic delays in global banking networks due to weak KYC/AML frameworks. These barriers restrict access to USD-clearing systems and limit the continent’s integration into global financial flows.

4. Disrupted Exports and Worsening Trade Terms

While Africa saw strong export performance in the late 2010s — driven by high commodity prices — the 2020s began with a series of external shocks that hit dollar inflows hard.

- COVID-19 lockdowns suppressed global demand and halted tourism, a major source of FX for several economies.

- The return of global inflation and tight US monetary policy raised the cost of borrowing and imports.

- The Russia–Ukraine war drove up prices for oil, food, and fertilizer — further straining import-dependent countries. Even for oil-producing nations, the net effect has been tighter liquidity and higher FX costs.

5. Even Intra-African Trade Relies on the USD

Despite being neighbors, many African countries settle bilateral trade in USD due to:

- Lack of trust in local currencies

- Limited convertibility

- Weak or fragmented regional payment systems

While these challenges are deeply entrenched, there are signs of momentum toward change. Across the continent, efforts are underway to build regional financial infrastructure that could, over time, ease dependence on the US dollar for intra-African transactions.

- The East African Payment System (EAPS), for example, allows real-time local currency settlements between East African Community (EAC) members.

- The Pan-African Payment and Settlement System (PAPSS) — developed by Afreximbank — and the broader AfCFTA framework also aim to support local currency trade across borders.

- According to Wamkele Mene, Secretary General of AfCFTA, some cross-border transactions in West Africa are already being settled in local currencies within ECOWAS.

However, these systems are still in their infancy, with limited adoption to date. In the meantime, the costs of dollar dependence remain substantial. Afreximbank estimates that Africa loses $5 billion every year in transaction fees from settling intra-African trade in external currencies like the USD. This underscores not only the depth of the dollar’s entrenchment, but also the urgency of building more efficient, scalable alternatives

Introducing Juicyway: Unlocking Real-Time Access to Hard Currencies in Africa

Juicyway is a fintech platform reimagining how emerging markets — particularly in Africa — can access hard currencies like USD, GBP, and CAD. Instead of relying on traditional intermediaries, Juicyway uses real-time matching technology to directly connect local demand with global supply sources, including remittances, foreign portfolio investments, stablecoin flows, and foreign direct investment.

At its core, the platform functions as an orchestration layer, streamlining currency exchange by matching buyers and sellers transparently and instantly. This approach not only enhances liquidity, but also supports a more sustainable revenue model driven by natural market flows rather than capital-heavy float strategies.

What makes Juicyway different:

- User-Driven Price Discovery: Through an advanced order book system, users can set desired exchange rates or transact at live market rates. This enables true price discovery and incentivizes participation from both formal and informal actors in the FX ecosystem.

- Designed for Individuals and Businesses: Individuals can open multi-currency accounts to send payments, settle bills, or receive remittances seamlessly. While businesses can use the platform to send and receive funds locally and internationally — at market rates, without friction.

- African Liquidity, First: Juicyway’s initial focus is on unlocking foreign currency liquidity for African markets, beginning with Nigeria.

- Strong Compliance Infrastructure: Licensed across key markets — including the US, UK, and Canada — Juicyway has built a robust compliance framework. The team includes experienced regulatory leaders like Joshua Wasserman, a former US federal regulator, ensuring rigorous KYC/AML protocols.

In Conversation with Ife Johnson, CEO of Juicyway

What inspired you to start Juicyway?

It was both personal and professional. On a personal level, I’ve experienced the frustration of being unable to fully participate in the global economy. And professionally, working at companies like Bamboo and Okta, I saw firsthand how difficult it was for businesses to move money out of the continent quickly and efficiently. There just weren’t any fintech solutions truly solving that problem.

At the same time, I’d been following crypto since 2010. I was fascinated by how stablecoins, in particular, could unlock faster, more direct movement between local currencies and the US dollar — without the need for correspondent banks. For me, crypto’s true utility in Africa is rethinking how local currencies interact with hard currencies. If you’re holding something like USDC or even Bitcoin, you’re essentially holding something redeemable for USD. That insight shaped the foundation of Juicyway. We didn’t just add crypto as a layer — we built the entire infrastructure around it. It’s the plumbing. It allows us to offer liquidity 24/7 and bypass traditional gatekeepers.

How do you see Juicyway evolving in the coming years?

Our long-term vision is to make it easier for the Global South to trade with itself. Right now, if I want to exchange Nigerian Naira for Central African CFA Franc in Cameroon for instance, I still have to go through the US dollar — there’s no direct liquidity pool between those currencies. That’s the world we’re trying to change. But we have to start where liquidity already exists: for the Global South that is with USD corridors, the Global North and Asia. Our current focus is matching that supply of hard currency with demand in Nigeria — efficiently, in real time.

Once we’ve built strong liquidity depth in those channels, we can start unlocking liquidity between underserved corridors. Countries like Nigeria and Benin Republic trade hundreds of millions of dollars with each other, but there’s no deep FX market between them. Our aim is to become the infrastructure that powers those flows.

What’s the biggest misconception about the problem you’re solving?

People assume this is a liquidity problem — that to solve it, you need to raise massive amounts of working capital. But we’ve seen that those models don’t scale well. The cost of capital gets passed onto the customer, and you’re constantly trading against yourself. We took a harder route, but a more scalable one: build a product-led flywheel that can organically originate supply and match it to demand in near real time.

Another big misconception is that cross-border payment challenges can be solved with the right licenses, payment rails, and banking partners. That’s necessary — but not sufficient. This is an orchestration problem, not just an access one. You need operational excellence and tech that can scale. Can your system orchestrate $5 billion in monthly transaction volume? That’s the real benchmark.

What have you learned from building in this space that other fintech founders should know?

Never underestimate the importance of compliance. Our Head of Compliance, Joshua Wasserman, came from the US federal regulatory system. He’s audited banks. He understands how global systems work. Having him on our team has been invaluable.

Also, fintech founders sometimes overlook the power of experience. Get people around you who deeply understand banking, regulation, infrastructure. Don’t try to build in a vacuum. There’s a real advantage in having operators and coaches who’ve seen this all before.

What are your thoughts on incoming infrastructure like PAPSS and its role in enabling cross-border payments?

PAPSS is an interesting development, and I respect the ambition. But I struggle to see how it will scale effectively, because it’s still built on legacy systems and correspondent banking infrastructure. At Juicyway, we’re building something similar in intent — creating an exchange layer for African currencies — but we’re doing it with a focus on efficiency, modern architecture, and liquidity orchestration.

Final Thoughts

Access to US dollars remains one of the biggest bottlenecks for African economies — impacting everything from trade and remittances to debt servicing and business growth. And the cost of this dollar dependency is significant.

According to McKinsey, if intra-African trade were settled in local currencies rather than the US dollar, the continent could save up to $5 billion annually in FX-related transaction costs alone.

While the demand for hard currency isn’t going away anytime soon, the ways in which it’s accessed remain fragmented, inefficient, and costly. Platforms like Juicyway are rethinking this challenge — not by replicating legacy systems, but by building infrastructure that is faster, more transparent, and better suited to the realities of African markets.

Here’s how you can support their mission:

- Learn more and follow their journey at juicyway.com

- Explore how their platform is unlocking hard currency liquidity across Africa

- Share this story with anyone exploring new ways to solve hard currency access and cross-border liquidity challenges in Africa

Know other startups tackling cross-border currency issues on the continent? I’d love to hear about them. What do you see as the biggest barriers — or opportunities — in this space? Feel free to drop a comment or reach out directly.

About the Author

Victoria Olayide Adesanya is an emerging fund manager with over a decade of experience in finance. She has advised leading investment banks like Morgan Stanley and held roles at Credit Suisse and Barclays. As an active angel investor, venture partner and advisor, Victoria supports startups focused on financial inclusion and cross-border payment challenges in Africa. Based in New York City, she holds a First Class degree from the University of Nottingham and is a CFA charterholder.

Get the Latest from Bridging Borders with Africa

Be the first to read our in-depth analysis, founder interviews and cross-border fintech insights.